Implement What You Know with Confidence

Discover action-based tools that provide simple steps for program improvement or robust plans for new ways of doing business.

Your ethics and compliance program is an ecosystem of moving parts. New laws and regulations, new lines of business, new geographies, mergers and acquisitions become part of a growing enterprise that your compliance ecosystem must support.

Effective compliance programs are able to deftly navigate these complexities because they have built strong foundations that were developed with the nature of the compliance industry in mind.

This section will give you the expert advice and programmatic best practices to ensure the first steps you take to develop your program are in the right direction. Or if your program is more mature, these resources and insights will give you the necessary guidance to course correct and improve your program’s foundation at whichever stage it is in.

Chapter 2 of The Worst-Case Scenario Survival Guide for Compliance Professionals

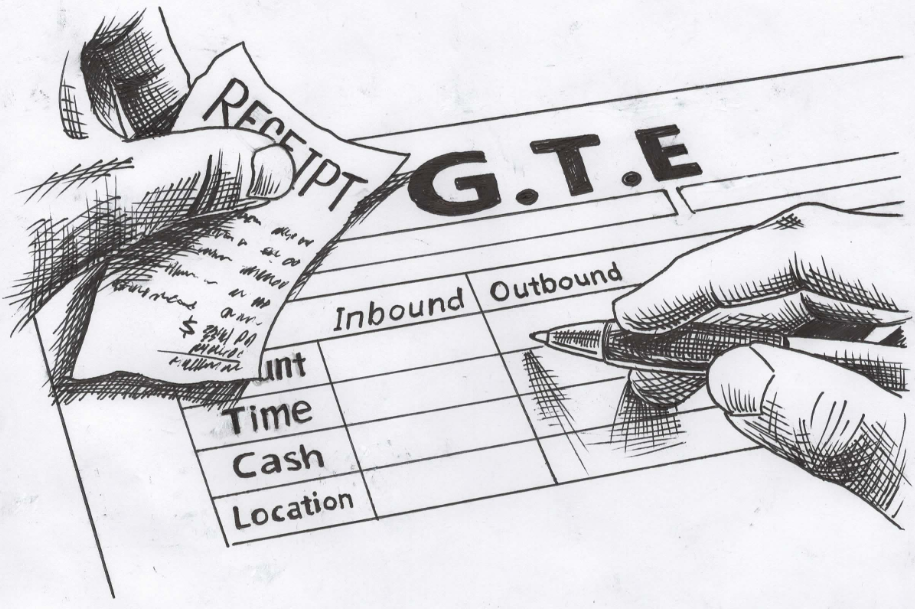

The FCPA world is littered with enforcement actions against companies for the most basic of compliance failures – those around gifts, travel and entertainment (GTE). Learn how to survive with Tom Fox.

Chapter 2 of The Worst-Case Scenario Survival Guide for Compliance Professionals

The FCPA world is littered with enforcement actions against companies for the most basic of compliance failures – those around gifts, travel and entertainment (GTE). Learn how to survive with Tom Fox.

Many compliance professionals struggle with issues from GTE: Violations can arise out of anything from discrepancies between outbound and inbound reporting to simply relying too heavily on the manual process of maintaining spreadsheets.

1. Document, Document, Document

You have policies in place – great. Now prove that you follow them. It is not the government’s responsibility to prove that you violated the FCPA. It is your responsibility to prove that you didn’t. This means you need to document both the existence of your compliance program as well as its effectiveness. For instance, if your company provides travel to foreign officials, you need to document the exact business purpose of that travel or it could become problematic.

2. Don’t Go to Disneyland Unless Your Office is in Tomorrowland

There is nothing to prevent your company from bringing foreign government officials to the U.S. or any other facility to attend meetings, observe your manufacturing process or to provide training. The key is that you must actually have facilities in those locations. That mean no trips to Disneyland, Las Vegas, the Grand Canyon or any other location where you do not have physical facilities.*

3. Make Sure Expenses are Relative to Where they are Being Spent

You can make some cash payments to foreign officials for travel expenses but they must be small ($50 or less), and you must have documented receipts for the expenditures. Consider the relative value of the cash you provide compared to the annual income of the country from where the officials are traveling. This means that if you give an official $100 and the country’s annual per capita income is less than $1,000, you have a problem.**

4. Add Up all the Small Things

Many companies are comfortable with small gifts of up to $250, which can be given without pre-approval. However, even small gifts can add up to large overall dollar amounts. How is your company assessing how much is spent by one business unit, department or group in total? Are you tracking how much is spent on one government official, one government department or business unit of a state-owned enterprise? The aggregate amount must be determined and reviewed. In the GTE compliance world, size matters.***

5. Trust but Verify

Most companies require employees to report GTE provided to foreign officials or employees of state-owned enterprises. However, are you certain your own employees are reporting correctly and accurately? What if your company decided to reconcile its outbound GTE register (the GTE given) with its inbound GTE register (the amount your internal expense system says you have given)? If there is a discrepancy, you may have a problem.

Employees are always eager to get their money back, but they may be far less eager to complete the necessary records. While some companies have a direct linkage between their expense system and GTE register, many still do not. It is this sort of exposure that companies continue to face, with often significant consequences.

Comments

Write your reply...