On January 1, 2021, the Conflict Minerals Regulation (EU Regulation 2017/821) came into full force across the EU. This new law aims to ensure that importers of certain materials originating from conflict-affected and high-risk areas source these materials responsibly by laying down supply chain due diligence obligations.

With many jurisdictions actively seeking to implement environmental, social and governance (ESG) legislation, the supply chain risks associated with conflict minerals mining and trade cover a broad spectrum. Money laundering and corruption, child and forced labor, human trafficking, smuggling, and organized crime, as well as environmental damage, are all problems associated with minerals derived from politically unstable areas.

Although some EU-based companies have already developed conflict minerals due diligence schemes, either as a result of voluntary efforts or due to obligations arising from activities in the US, the current legislative developments reflect the need to enhance these efforts and address evolving ESG challenges.

Minerals Covered

The term 'conflict minerals' commonly refers to tin, tantalum, tungsten and gold (the "3TGs"), as covered by the EU regulation. 3TGs are widely used in the electronics, automotive, medical devices, tooling, and aerospace industries, often ending up in everyday products including cars, mobile phones, laptops, and jewelry. Multinationals can knowingly or sometimes unknowingly be affected by having them in their supply chains.

Because of their wide use in everyday products, the demand for 3TGs has increased significantly over the last decade. Consequently, these minerals' mining and trade have become ever-more lucrative, with armed groups and criminals seeking to control them to finance their activities. De-funding these armed militias is the primary goal of the new regulation.

Other initiatives on responsible mineral supply chains, both legislative (the US Dodd-Frank Act) and voluntary (the OECD Due Diligence Guidance for Responsible Supply Chains from Conflict-Affected and High-Risk Areas), cover the same four minerals.

When developing your due diligence scheme, it is crucial to bear in mind that the scope of minerals covered by the new regulation is likely to be expanded. Either this year or next, the EU will carry out an assessment to determine which minerals should be added. Cobalt in particular is likely to be included, due to its importance in creating the lithium-ion batteries needed to support the transition to low-carbon economies.

Annex 1 of the EU regulation provides more details of the minerals currently covered, their ores, concentrates and other forms, as well as products containing them (such as wires, bars and sheets) with Combined Nomenclature codes. The Regulation exempts small imported volumes of 3TGs introducing certain annual volume thresholds to provide relief for smaller importers.

Locations Covered

Previous legislation, such as the US Dodd-Frank Act, has focused on conflict minerals sourced from specific areas – notably, the Democratic Republic of Congo (D.R.C) and surrounding Great Lakes territories. The combination of long-term instability and unrest in an area that contains rich deposits of 3TGs sadly made this region a hotbed of human rights abuses, corruption and money laundering that aided the financing of armed groups.

The new EU regulation, however, expands the focus to cover 3TGs sourced from conflict-affected and high-risk areas that might exist all over the world:

'conflict-affected and high-risk areas' (CAHRAs) means areas in a state of armed conflict or fragile post-conflict as well as areas witnessing weak or non-existent governance and security, such as failed states, and widespread and systematic violations of international law, including human rights abuses.'

The European Commission has tasked a group of external experts to provide and regularly update an indicative, non-exhaustive list of CAHRAs under the EU regulation.

Companies Covered

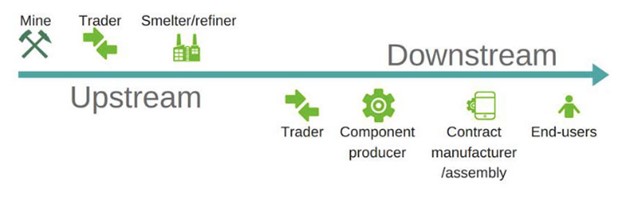

The mineral supply chain involves a number of actors engaged in moving and processing the minerals from the extraction site to their incorporation in the final product. 'Upstream' companies extract, process, and refine minerals, whereas 'downstream' firms further process metals into a finished product and sell them to end-users.

A graphic representation of a mineral supply chain. Source: EU Commission

The EU regulation directly applies to upstream and downstream firms when they import the targeted minerals or metals into the EU. 'Downstream' users of 3TGs, i.e., manufacturers, importers, and sellers of finished products and components that contain 3TGs are out of scope with no mandatory due diligence obligations. However, they may be required to provide voluntary reports. There are also no obligations for transporters, intermediaries or investors.

Indirectly, companies from outside of the EU will also be impacted. The EU importers will cascade down the responsible sourcing requirements to smelters and refiners by assessing the due diligence schemes they have in place. Pursuant to the regulation, The European Commission will publish and regularly update whitelists of global responsible smelters and refiners.

Key Requirements for Importers

EU importers of minerals and metals are required to follow a five-step due diligence framework and carry out the following activities:

- Establish strong company management systems.

- Identify and assess risk in the supply chain.

- Design and implement a strategy to respond to identified risks.

- Carry out an independent third-party audit of supply chain due diligence.

- Report annually on supply chain due diligence efforts.

These steps draw on the due diligence framework set out in the OECD Guidance, an internationally recognized standard in the mineral supply chain due diligence area. First adopted in 2011, the current version from 2016 has two supplements (Supplement on Tin, Tantalum and Tungsten, and Supplement on Gold) tailored to the challenges associated with these minerals' supply chain structure. The supplements translate the five-step framework into great detail for each level of the mineral supply chain.

Key Differences to Dodd-Frank

US conflict minerals regulations (in particular, Section 1502 of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010) have also referred to the OECD Guidance as a suitable due diligence framework. Although this is an important similarity between the two regulatory frameworks, the US law has the following key points of difference to the EU regulation:

The enforcement of the EU regulation will take place in the member states, with competent national authorities laying down the rules applicable to infringements. The regulation provides for a planned review of the legislation effectiveness by January 2023 to assess whether the member states should be given the competence to impose penalties "in the event of persistent failure to comply with the obligations set out in the Regulation".

What Actions Should Affected Organizations Be Taking?

Many multinational companies established in the EU have already adopted conflict minerals due diligence schemes to comply with the US regulations. If this is not the case and you start from scratch with your program, or if you feel your supply chain processes might be at risk due to the differences between the EU and US regulatory frameworks, consider the following key steps to take:

1. Determine how the new regulation applies to your company

This is likely to include mapping your supply chain all the way down to the primary source to understand the origins of minerals and possible 3TGs risks your organization is facing. An in-depth understanding and high level of visibility are key to determining which suppliers should be involved in your risk-mitigating efforts and how this should be done. Consider addressing the following questions:

- What is the company's current visibility of the supply chain?

- What is the current nature of relationships between the company and its suppliers?

- Which existing supply chain policies are in place?

2. Focus on strong management systems

To effectively address the risks associated with conflict minerals, start from the management systems. Along with getting leadership buy-in, securing the program budget and determining the key roles and responsibilities, make sure you cover the following:

- Ensure senior management oversight of conflict minerals compliance program.

- Adopt a supply chain policy and communicate it to suppliers and the wider public.

- Incorporate supply chain policies and traceability into contracts and agreements with suppliers.

- Establish an internal or external (i.e. ombudsperson) mechanism for whistleblowers that deals with concerns about the due diligence process.

3. Identify, assess and respond to supply chain risks

With a solid foundation in place, you can move on to the due diligence process. Assess your risks by identifying the factual circumstances of your company's activities and supplier relationships, then benchmark what you have found against the best practices and regulatory requirements. In practice, your due diligence is likely to be structured around the following steps:

- Liaise with suppliers to identify and assess the supply chain risks of adverse impacts based on the available third-party audit reports on smelters and refiners. In the absence of such reports, obtain independent third-party reports as part of the due diligence.

- Design and implement a strategy to respond to the identified risks, adopt risk-mitigating measures and track the progress.

- Integrate the conflict minerals compliance program with other supply chain compliance activities and sustainability agenda to leverage potential efficiencies.

- Document as you go and maintain internal records for a minimum of five years.

Notable industry initiatives include:

- The International Tin Supply Chain Initiative (ITSCI);

- The Responsible Gold Mining Principles developed by the World Gold Council; and

- The responsible sourcing protocols launched by the London Metal Exchange.

- End users of minerals, such as manufacturers, electronics and technology companies, also have the Responsible Minerals Initiative